Learn about the latest News & Events for Town of Barnstable, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for Town of Barnstable, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

Sean O’Brien, Town Treasurer, announced that the Town received competitive bids from bond underwriters on Tuesday, May 6, 2025, for a $5,435,000, 20-year general obligation bond issue. FHN Financial Capital Markets was the winning bidder on the Bonds with an average interest rate of 3.662%. The Town received a total of 8 bids on the Bonds. Bond proceeds will be used to finance various municipal projects.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s robust tax base growth and economic development, long history of surplus financial results and strong budgetary performance as positive credit factors.

The bids for the Bonds were accepted at the offices of the Town’s Municipal Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

For Further Information, Contact:

Sean O’Brien

Town Treasurer

230 South Street

Hyannis, MA 02601

Tel: (508) 862-4653

(HYANNIS, MA – March 9, 2023) Sean O’Brien, Town Treasurer, announced that the Town of Barnstable received competitive bids from bond underwriters on Wednesday, March 8, 2023, for a $14,550,000, 20-year general obligation bond issue. Janney Montgomery Scott LLC was the winning bidder on the Bonds with an average interest rate of 3.25%. The Town received a total of ten (10) bids on the Bonds. Bond proceeds will be used to finance various municipal projects.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s strong wealth and income indicators, comprehensive set of formalized financial policies and practices, history of strong financial performance with maintenance of very strong reserves, low overall debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds were accepted at the offices of the Town’s Financial Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

Every year cities and towns in the Commonwealth of Massachusetts are required to submit a set of financial statements to the Massachusetts Department of Revenue – Division of Local Services, to have their surplus funds for the General Fund and Enterprise Fund’s certified. This is known as the “Free Cash Certification”. Free cash is the cash in the community’s treasury on July 1 that is free of any encumbrance and may be appropriated for use.

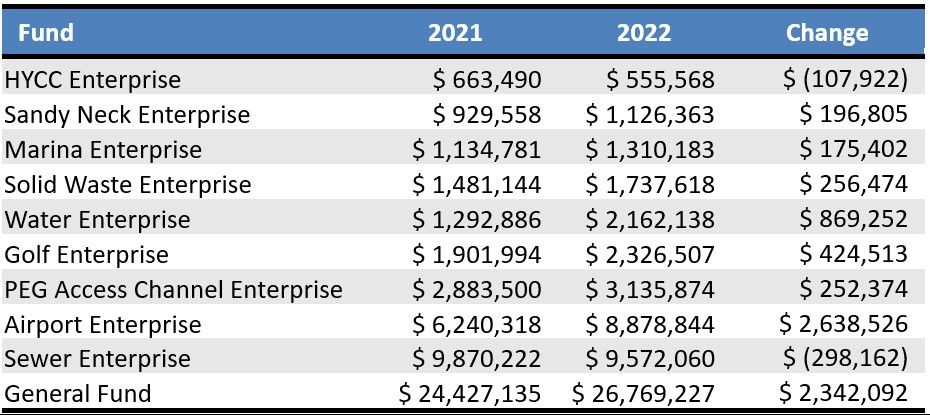

On October 12, 2022 the Town of Barnstable received its certification. The table below illustrates the certified amounts for each fund compared to the amount certified on the previous July 1 date. Certified amounts for each community can be viewed online using the following link: https://dlsgateway.dor.state.ma.us/gateway/DLSPublic/CertificationFreeCashPublicReport/CertificationFreeCashPublic

The decrease in the HYCC and Sewer enterprise operations are the result of surplus appropriated for the Fiscal Year 2023 capital and operating budgets. The increase in all the other funds is the result of surplus generated at the close of Fiscal Year 2022 exceeding any surplus used to balance the Fiscal Year 2023 capital and operating budgets for those respective funds. These amounts are available for the Fiscal Year 2024 budget development as well as any Fiscal Year 2023 unplanned expenditures.

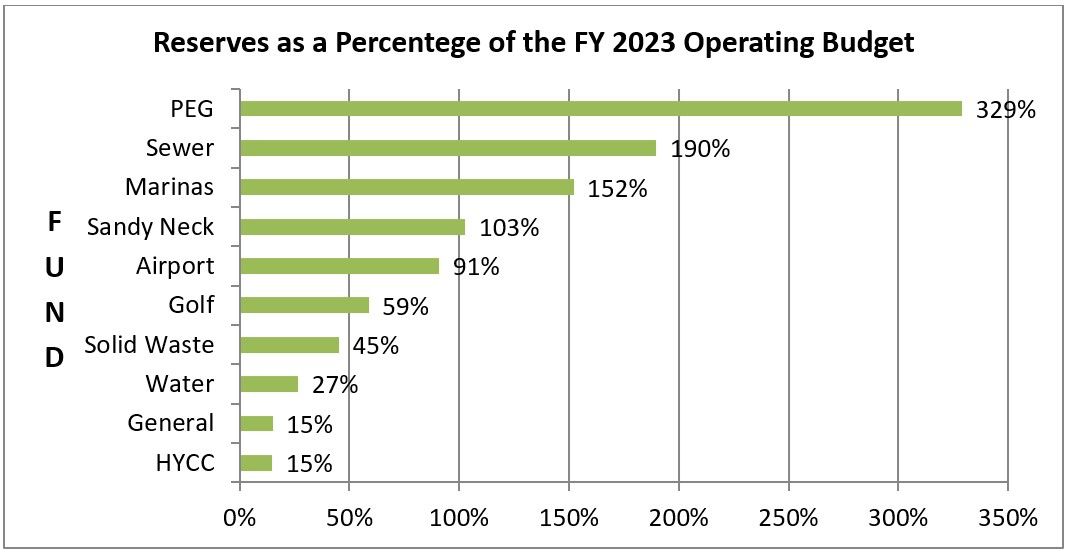

Four enterprise funds have a surplus that was certified in excess of their Fiscal Year 2023 operating budgets. The Airport Fund is close to having 100% of its operating budget in reserves. The town’s target reserve balance for the enterprise funds is in most cases 50%, or 6 months depending upon the fund’s revenue stream volatility, capital needs and it susceptibility to extraordinary and unforeseen expenses. The HYCC enterprise fund is well below this level and is acceptable as it receives significant General Fund subsidies on an annual basis. The enterprise fund model is only used so that management can easily measure this subsidy. The town’s General Fund policy is 4% and the reserve level is nearly 4 times this amount at 15%.

(BARNSTABLE, MA – March 3, 2022) The Town of Barnstable’s Treasurer Debra

Blanchette announced that the Town received competitive bids from bond underwriters on Tuesday, March 1, 2022, for a $11,475,000, 20-year general obligation bond issue. Piper Sandler & Co. was the winning bidder on the Bonds with an average interest rate of 2.13%. The Town received a total of seven (7) bids on the Bonds. Bond proceeds will be used to finance various municipal projects.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s strong wealth and income indicators, comprehensive set of formalized financial policies and practices, history of strong financial performance with maintenance of very strong reserves, low overall debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds were accepted at the offices of the Town’s Financial Advisor,

Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

Debra Blanchette, Town Treasurer, announced that the Town received competitive bids from bond underwriters on Wednesday, March 10, 2021, for a $12,695,000, 20-year general obligation bond issue. Morgan Stanley & Co., LLC was the winning bidder on the Bonds with an average interest rate of 1.33%. The Town received a total of 10 bids on the Bonds. Bond proceeds will be used to finance various municipal projects and, together with available funds of the Town, refinance bonds of the Town originally issued June 15, 2010 and June 14, 2011. The refinancing will generate gross budgetary savings of $1,071,079 over the remaining life of the bonds refunded.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s very strong economy, very strong management with strong financial policies and practices, strong budgetary performance, very strong budgetary flexibility, very strong liquidity, strong debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds were accepted at the offices of the Town’s Financial Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

(BARNSTABLE, MA) Debra Blanchette, Town Treasurer, announced that the Town of Barnstable received competitive bids from bond underwriters on Tuesday, February 9, 2021, for a $2,745,000, 15-year taxable bond issue. Robert W. Baird & Co., Inc. was the winning bidder on the Bonds with an average interest rate of 1.20%. The Town received a total of five (5) bids on the Bonds. Bond proceeds will be used to finance private roadway improvements.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s very strong economy, very strong management with strong financial policies and practices, strong budgetary performance, very strong budgetary flexibility, very strong liquidity, strong debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds were accepted at the offices of the Town’s Financial Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

Debra M. Blanchette, Town Treasurer, announced that the Town of Barnstable received competitive bids from bond and note underwriters on Wednesday, February 5, 2020, for a $10,855,000, 20-year bond issue and a $2,052,950, 1-year taxable note issue. Morgan Stanley & Co., LLC was the winning bidder on the Bonds with an average interest rate of 1.69%. Piper Sandler & Co. was the winning bidder on the Notes with a net interest cost of 1.88%. The Town received a total of nine (9) bids on the Bonds and five (5) bids on the Notes. Bond and Note proceeds will be used to finance various capital projects.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s very strong economy, very strong management with strong financial policies and practices, strong budgetary performance, very strong budgetary flexibility, very strong liquidity, strong debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds and Notes were accepted at the offices of the Town’s Financial Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.

Debra Blanchette, Town Treasurer, announced that the Town received competitive bids from bond and note underwriters on Wednesday, February 6, 2019, for a $10,540,000, 20-year bond issue and a $2,052,950, 1-year taxable note issue. Morgan Stanley & Co., LLC was the winning bidder on the Bonds with an average interest rate of 2.52%. Oppenheimer & Co., Inc. was the winning bidder on the Notes with a net interest cost of 3.05%. The Town received a total of 9 bids on the Bonds and 3 bids on the Notes. Bond and Note proceeds will be used to finance various capital projects.

Prior to the sale, S&P Global Ratings, a municipal bond credit rating agency, affirmed the Town’s ‘AAA’ bond rating, the highest rating attainable. The rating agency cited the Town’s very strong economy, very strong management with strong financial policies and practices, strong budgetary performance, very strong budgetary flexibility, very strong liquidity, strong debt and contingent liability profile, and strong institutional framework as positive credit factors.

The bids for the Bonds and Notes were accepted at the offices of the Town’s Financial Advisor, Hilltop Securities Inc., at 54 Canal Street in Boston, Massachusetts.